vermont state tax department

SUT-451pdf 17703 KB File Format. The mission of the Vermont Department of Taxes is to provide a fair and efficient tax system that enhances Vermonts economic growth.

Vermont S Budget Has A Few Wealthy People To Thank

Business Tax Center Find guidance on paying taxes as a business in Vermont.

. Average annual salary was 52582 and. Number of employees at Vermont Taxes Department in year 2021 was 176. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal.

Department of Taxes Check Return or Refund Status No. Vermonts tax system ranks 43rd overall on our 2022 State Business Tax Climate Index. Each states tax code is a multifaceted system with many moving parts and Vermont is no.

Freedom and Unity Live. PUBLIC INFORMATION REQUESTS TO. Vermont School District Codes.

Learn about the regulations for paying taxes and titling motor vehicles. No additional tax will be due if the tax paid on an out-of-state registered vehicle was equal to or more than the Vermont tax rate. Start filing your tax return now.

MyVTax Payment Portal Vermontgov Freedom and Unity. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. Vermont Department of Taxes VT Taxation phone.

Highest salary at Vermont Taxes Department in year 2021 was 131142. Sign Up for Email Updates. Click here for phone number s Local.

If you are doing business in Vermont you are likely. Vermont Department of Taxes. Tuesday November 1 2022 - 1200.

Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont. The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration. TAX DAY IS APRIL 17th -.

Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone. Form SUT-451 Sales and Use Tax Return. Vermont Department of Motor Vehicles 120 State Street.

Detailed Vermont state income tax rates and brackets are available on this page. Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate Claim and Estimated Payments. W-4VT Employees Withholding Allowance Certificate.

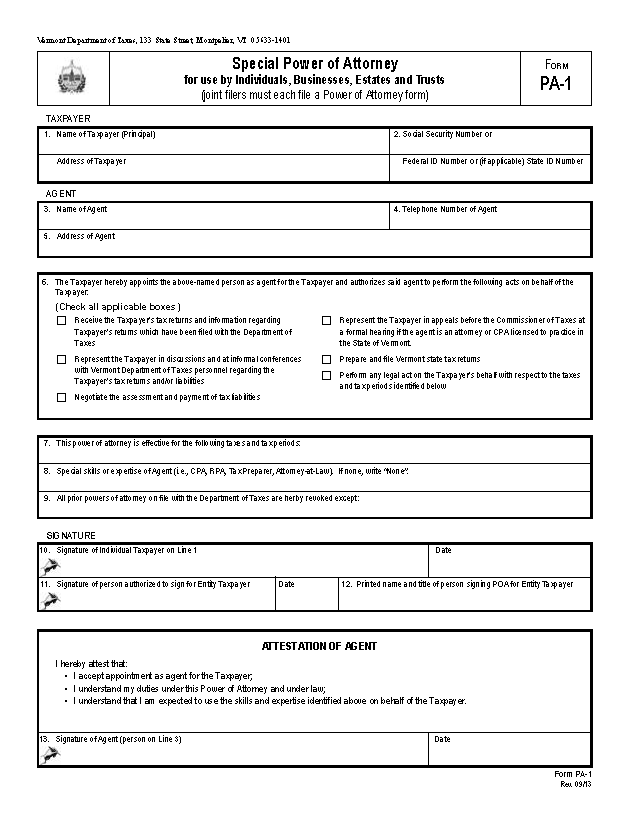

802 828-2301 Toll Free. Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes. PA-1 Special Power of Attorney.

Send us a Message. Below you will find information about the various taxes for businesses and corporations operating in Vermont. IN-111 Vermont Income Tax Return.

Town Officer Education Conference Uvm Extension Cultivating Healthy Communities The University Of Vermont

Vermont Tax Information Town Of Craftsbury

Vermont Department Of Taxes Notice Of Changes Sample 1

Vermont Department Of Taxes Montpelier Vt

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Hud Gov U S Department Of Housing And Urban Development Hud

/cloudfront-us-east-1.images.arcpublishing.com/gray/AUU4WKVNHRIORAI46KVTDIHJH4.jpg)

What S That Vt Use Tax Letter And Do You Have To Pay

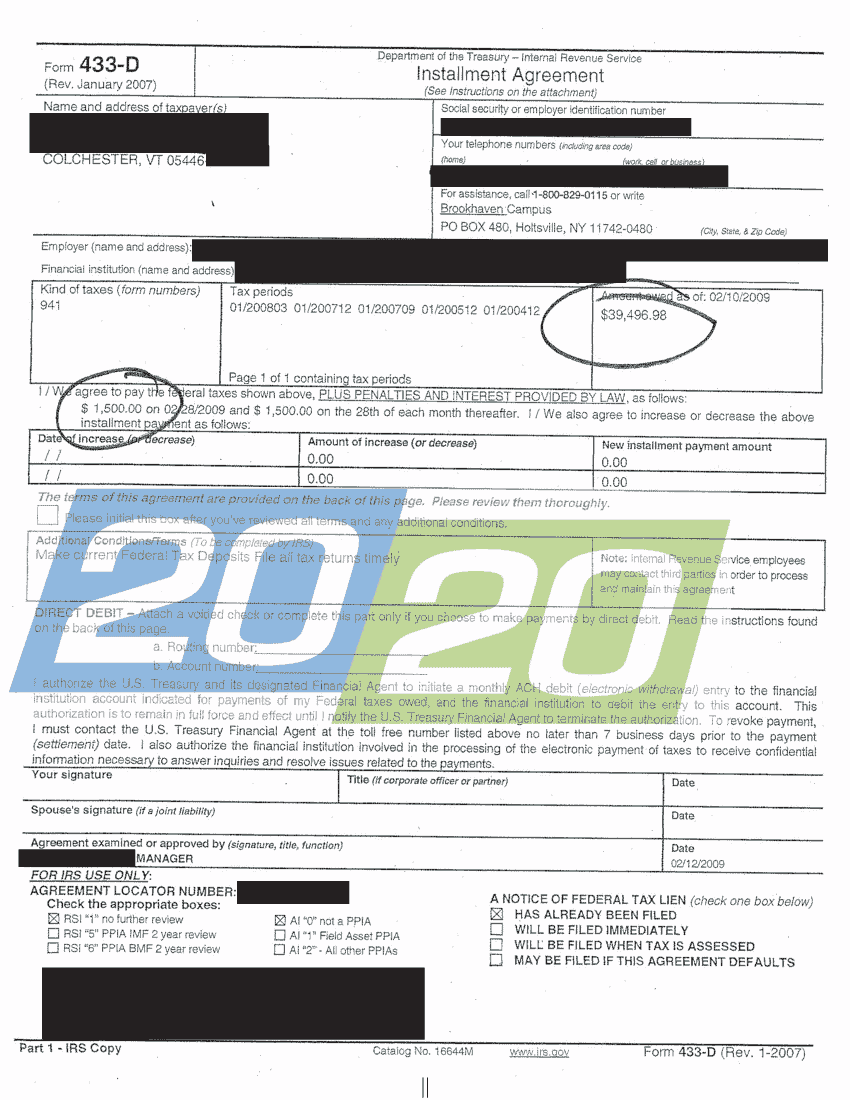

Irs Accepts Installment Agreement In Colchester Vt 20 20 Tax Resolution

Vermont Registration Tax Amp Title Application Vermont Department Of

Free Vermont Tax Power Of Attorney Form Pa 1 Pdf Word

Income Tax Assistance Broc Community Action

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

Property Tax Flyer Halifax Vermont Halifax Vermont Halifax Vermont

Vermont Tax Information Town Of Craftsbury